Today's economic crisis is obvious and not so obvious at the same time. Everyone sees the gas prices fluctuate from day to day and think that they have a handle on what is going on with America's finances, but I'm willing to bet that the average voter probably can't explain the process of credit institutions and how their stability can affect the market. We've all seen news reports, debates, headlines in the newspapers, and probably online stories from all over the US but all the information is getting lost as it piles up on the heads of the people who don't fully understand it.

I know all this because I am one of the people that don't fully understand it. I read a lot and do a lot of research before I formulate most of my opinions, but the information out there is a bit much to take. There appears to be an agreement that the financial security in America is at stake, but the way to go about healing it is where all the confusion comes in.

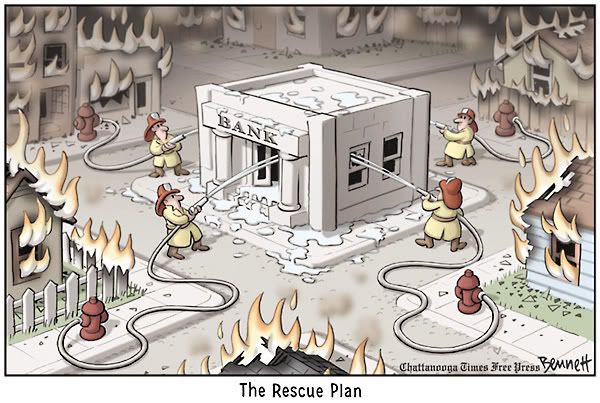

The White House wants to bail out the financial institutions that are struggling with foreclosed properties and bad debt. Their hope is that by purchasing these bad debts from the banks it will allow them to become healthy again where they can continue to dole out loans to people who need them for businesses, personal property, and homes. It's the classic "trickle down" economic process that promotes helping out the biggest companies so that they can in turn create jobs,give loans, and stimulate spending.

But, what if, by relieving the banks of the results of their own mistakes, they only go out and make the same mistakes again? Or maybe they won't. But, what's stopping them from doing so? By bailing these companies out we're giving them the message that they can do whatever they want and even if their company fails they'll still collect.

I know that if the economy continues its nosedive that America as we know it could radically change. But, I fail to see what I should be fearing by this change. Let it fall. It's a machine that was built by the wealthy to become wealthier by feeding off of the majority. It's wrong and it deserves to tumble. My guess is that the majority will survive just fine, those that don't rely on the government (their neighbors) to support their lifestyle. For the others, it can only serve as a wake up call to a broken system.

While it may be a difficult road, one in which that us fat and lazy Americans aren't used to, I think that we'd be better off letting the bottom fall out and starting over with a much more aware society rather than this willfully ignorant one. Many will disagree with me and I welcome any comments for or against my position, but I would like to ask these people who are for a government bailout a two-part question: Can you explain to me what you expect that this bail out will save? And, if saving our current mode of operations is your answer, then what is it about the current mode of operations that is so worth saving?

skip to main |

skip to sidebar

- Home

- Downloads

- Software

- Excel Creations

- GIMP Creations

- World Cup 2022 Printable Poster (PNG)

- World Cup 2018 Printable Poster (PDF)

- World Cup 2018 Printable Poster (PNG)

- Copa America 2016 Printable Poster (PDF)

- Copa America 2016 Printable Poster (PNG)

- Euro 2016 Printable Poster (PDF)

- Euro 2016 Printable Poster (PNG)

- World Cup 2014 Printable Poster (PDF)

- World Cup 2014 Printable Poster (JPG)

- Deck

- Sketchup Creations

- Blogs I Read

Labels

autobiography

(94)

home renovation

(64)

family

(62)

DIY

(56)

God

(45)

observation

(37)

food

(34)

opinion

(34)

truth

(34)

debate

(32)

life

(32)

automobiles

(30)

inspiration

(30)

comedy

(28)

history

(27)

controversy

(26)

politics

(24)

belief

(23)

Before & After

(22)

friends

(22)

health

(21)

Craigslist

(19)

technology

(19)

love

(18)

photography

(18)

marriage

(17)

soccer

(16)

work

(16)

art

(15)

Ford

(13)

game

(11)

movie

(11)

green

(10)

music

(10)

software

(8)

GIMP

(7)

creation

(6)

garden

(6)

9/11

(5)

Excel

(5)

book review

(5)

birthday

(3)

travel

(1)

Video

Profile

- Levi Felton

- I'm difficult to explain, but I will attempt. I am a fantastic husband, father, and employee. I have an amazing array of talents. I never stop leaving others in awe with my actions. I love my life, because my life is so great that it's virtually impossible not to love it. Finally, I also have a fair amount of self esteem. And people say that I'm often sarcastic but I don't know why.

Categories

autobiography

(94)

home renovation

(64)

family

(62)

DIY

(56)

God

(45)

observation

(37)

food

(34)

opinion

(34)

truth

(34)

debate

(32)

life

(32)

automobiles

(30)

inspiration

(30)

comedy

(28)

history

(27)

controversy

(26)

politics

(24)

belief

(23)

Before & After

(22)

friends

(22)

health

(21)

Craigslist

(19)

technology

(19)

love

(18)

photography

(18)

marriage

(17)

soccer

(16)

work

(16)

art

(15)

Ford

(13)

game

(11)

movie

(11)

green

(10)

music

(10)

software

(8)

GIMP

(7)

creation

(6)

garden

(6)

9/11

(5)

Excel

(5)

book review

(5)

birthday

(3)

travel

(1)

Design by Free WordPress Themes | Bloggerized by Lasantha - Premium Blogger Themes | Blogger Templates

1 comments:

I had a girl at work tell me something I really liked. If us as the taxpayers are going to bailout these companies then we as the taxpayers should own the companies and reap the profits. Like a good tax rebate when the company does well. We should defintely not let the same people who own the company now get bailed out and still reap the profits. Anyway I know it didnt go through I just thought that was an interesting statement.

Post a Comment